Vanguard ira calculator

Claim 10000 or More in Free Silver. For calculations or more.

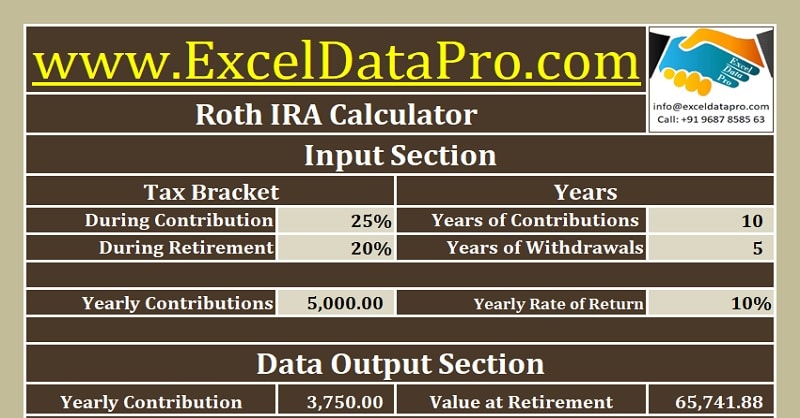

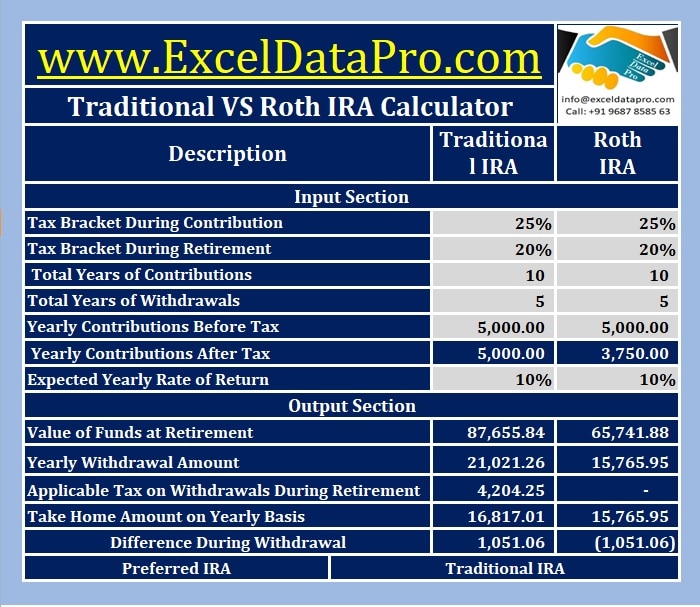

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Calculator Ira To Roth Conversion Vanguard A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the.

. While the annual IRA contribution limit of 6000 may not seem like much you can stack up significant savings. Assuming youre not about to retire next year you want growth as well as focused investments for your Roth IRA. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD.

By thousands of Americans. Start Plan savings Use this tool to determine the effect saving more. If youll soon need to take an RMD from your IRA or small business retirement account and you have questions youve come to the right place.

We recommend you contact a tax advisor to determine your actual contribution. It is mainly intended for use by US. Use this calculator to find out how much you need to contribute each pay period to reach the IRS savings limit by year-end.

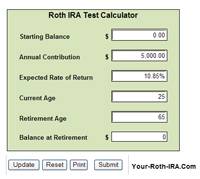

Vanguard Roth IRA Calculator. Find a Dedicated Financial Advisor Now. But make sure you understand the tax.

Ad Working Closely With You To Create A Personalized Plan To Help You Beyond Retirement. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Investment Income Calculator Enter values in any 2 of the fields below to estimate the yield potential income or amount for a hypothetical investment.

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Estimate the contributions you can make to our plans. Enter your clients data below to see their projected break-even tax rate BETR.

Taking Your RMD at Vanguard Transcript. Its equal to 50 percent of the amount you were supposed to withdraw. If you contribute 6000 yearly and realize a.

This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Thats because the tax benefits of a Roth account are difficult to capture fully with the traditional rule of thumbor even with the more sophisticated BETR calculation. Protect your retirement with Goldco.

Heres a hypothetical example. First place your contribution in a traditional IRAwhich has no income limits. We recommend you contact a tax advisor to determine your actual contribution.

Then move the money into a Roth IRA using a Roth conversion. Request Your Free 2022 Gold IRA Kit. Compare the features of a Vanguard-associated 529 savings plan to.

Allows speak about the three means to invest. Our BETR calculator helps you make IRA conversion with your clients best interest in mind. Ad Top Rated Gold Co.

Estimate the contributions you can make to our plans. Retirement expense worksheet Create a realistic budget for retirement that. Start Plan savings Use this tool to determine the effect saving more.

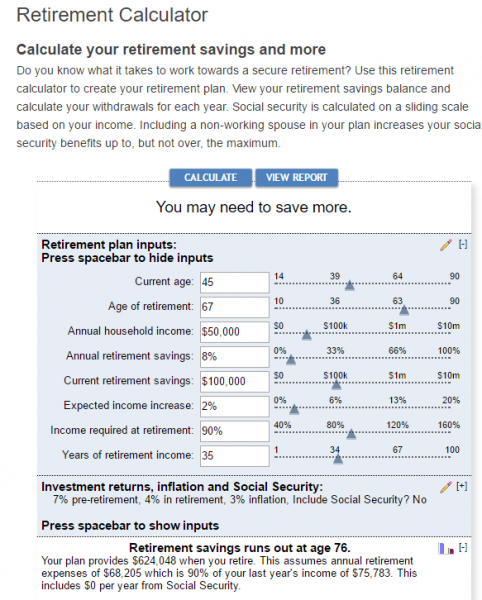

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Do Your Investments Align with Your Goals. Retirement income calculator Estimate the potential income you could earn from your investments.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Advice Powered By Relationships Not Commissions From A Financial Planner You Can Trust. Use this calculator to find out how much you need to contribute each pay period to reach the IRS savings limit by year-end.

900 1800 2700 3600 1883 3322 Plan Loan Alternative Loan Foregone investment return Total interest over the term of the loan. Advice Powered By Relationships Not Commissions From A Financial Planner You Can Trust. Ad Working Closely With You To Create A Personalized Plan To Help You Beyond Retirement.

Learn how our easy-to-use investment calculators and retirement tools can help you strengthen financial strategy. Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. How does this work.

For comparison purposes Roth IRA and regular taxable. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The Best Retirement Calculator Review I Review 26 In One Day Calculatormountain Chief Mom Officer

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Best Roth Ira Calculators

Quick And Easy Retirement Calculator Fpw

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Top Retirement Calculators The Fortunate Investor

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Ira Calculator See What You Ll Have Saved Dqydj

Roth Ira Calculators